Transmitting E-files

Once you've created an e-file, you can transmit the e-file via the Internet to the Electronic Filing Center (EFC). However, the following conditions must exist to transmit e-files:

- You must be connected to the Internet to transmit e-files to the EFC

- The return(s) that you're trying to e-file cannot be open

To transmit (or send) e-files:

You must have already created an e-file in order to send e-files. See Creating E-files.

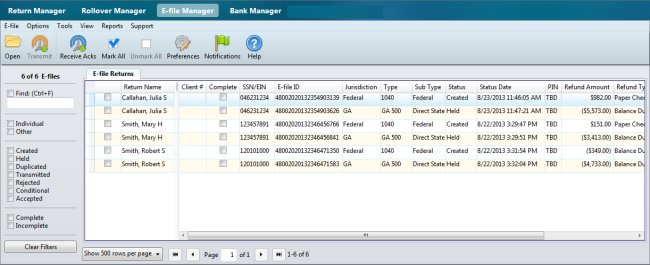

- Click the E-file Manager tab.

E-file Manager

Use filters to control which E-file Returns are displayed.

- Mark the e-file(s) you want to transmit.

- Do one of the following:

- Click the Transmit button on the toolbar.

- Click the E-file menu; then, select Transmit Marked E-files.

- Press Ctrl+T.

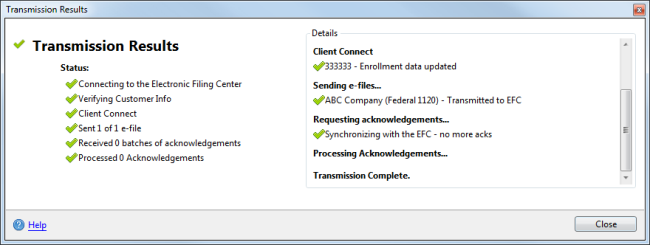

Transmit Marked E-files dialog box

Open returns cannot be transmitted. Only those returns that are marked in this dialog box will be transmitted.

If you're transmitting a 1041 Fiduciary return with a NY State Fiduciary return, both returns are selected automatically in the Transmit Marked E-files dialog box and will be transmitted simultaneously to the IRS. The state return is then forwarded to the New York agency.

- Click Transmit Marked E-files.

Transmit Marked E-files dialog box

- Click Close.

After transmitting e-files, Receive Acknowledgements periodically to update the e-file status to Accepted or Rejected. If Rejected, the e-file must be re-created and re-transmitted (after correcting any errors). See Common IRS Rejection Codes and Correcting E-file Rejection Errors. For information on known delays in ACKs, check the ATX Blog.

Rules Regarding Transmission

- Once transmitted, an e-file cannot be recalled or resubmitted, unless it is rejected.

- If you're unsure about a return, you can place it on Hold until you're ready to file it.

- Once transmitted, an e-file cannot be deleted from the E-file Manager.

- If you need to make changes to returns with a Transmitted status, wait until the return is either Accepted or Rejected. If the return is Accepted, file an amended return. If the return is Rejected, make the changes directly to the return, recreate the e-file and re-transmit.

See Also: